|

The growing need for affordable housing near Downtown Phoenix is being addressed by three apartment projects that combine affordability with amenities.

Pacific Oak Capital Advisors, a national leader in institutional-quality alternative investments, and Defer Gain, a leading Arizona-based real estate development company specializing in Opportunity Zone investments, have announced the signing of a joint venture arrangement to develop, finance, and operate multi-family, commercial, and industrial income producing properties in Arizona Opportunity Zones. The Pacific Oak – Defer Gain joint venture is kicking off its union with three multi-family projects in the Downtown Phoenix’s Presidential District, including the 241-unit St. Ambrose Apartments and the 84-unit Presidential Apartments both situated between 11th and 12th Streets and Van Buren and Jefferson Streets in Phoenix. Both projects are also strategically located next to the 12th Street light rail stops. The joint venture will also start construction in September 2019 on the work-force housing project known as the Imperial Apartments located near 20th Street & Roosevelt in Phoenix. The Imperial Apartments breaks ground next month, and will be Arizona’s premier, and much needed, work-force housing project located in the heart of the Edison Eastlake Choice Neighborhoods, which has begun a $150 million redevelopment project. The 140 unit private project will join the addition of 1,100 new City of Phoenix housing units, propelled by a $30 million federal grant recently awarded to the Choice Neighborhood. “The Imperial Apartments is located directly across from the soon to be expanded Edison Park, which is a significant amenity in the neighborhood,” said Michael Lafferty, Partner at Defer Gain. “We are excited to bring affordable, high quality, housing solutions to this fantastic neighborhood and be a part of its transformation with the City of Phoenix and Edison Eastlake stakeholders.” Phoenix Mayor Kate Gallego commented, “Adding quality housing is a top priority for our city. I am excited to see new housing, including much-needed workforce units, near our key job corridors in the downtown and airport area.” Defer Gain’s two Presidential District projects, St. Ambrose and Presidential Apartments, will continue co-founders Mr. Lafferty and Scott Tonn’s efforts to provide housing solutions in the area east of 7th Street near the City of Phoenix’s 12th Street Light Rail Station. “Defer Gain is one of the first developers to offer high-amenity efficiency apartment living in Downtown Phoenix,” said Tonn, a Defer Gain Partner and Co-Founder. “As well, we are very excited to implement the benefits of the newly minted Opportunity Zone legislation in conjunction with the local community to make St. Ambrose and Presidential Apartments significant additions for the neighborhood. This collaboration will also provide new residents with access to a dynamic job market in Downtown Phoenix.” “It’s exciting to see Opportunity Zone developments providing support to a critical component of our state’s economy — the workforce,” said Sandra Watson, President and CEO of the Arizona Commerce Authority. “We thank Pacific Oak and Defer Gain for advancing these three projects in downtown Phoenix neighborhoods.” Positioned at the 12th street light rail stops, both the Presidential and St. Ambrose Apartments are just one stop from Downtown Phoenix and three stops to Sky Harbor Airport. Both properties boast state-of-the-art amenities including luxurious lobbies, mail rooms including secured lockers for packages, grocery delivery cold/ freezer storage, clubhouses, multi-purpose rooms, private conference rooms, exercise facilities, resort style swimming pools, cabanas with private BBQ’s, secured ingress/egress, great walkability & easy access to public transportation. In addition, the Presidential Apartments offers large format on-site personal locker storage. While both properties feature street level retail/mixed-use opportunities, the Presidential Apartments will additionally include three open-air areas on Jefferson Street, adjacent to the light rail stop, which will attract local artists, pop-up businesses, food trucks, and events open to the public. “The collaboration between Pacific Oak Capital Group and Defer Gain will provide us a unique opportunity to penetrate the Arizona Opportunity Zone market,” commented Keith Hall, Co-founder of Pacific Oak. “We are delighted to be in partnership with Defer Gain’s team and look forward to being a dominant force in the Arizona OZ space for years to come.” Source: AZ BIG MEDIA

1 Comment

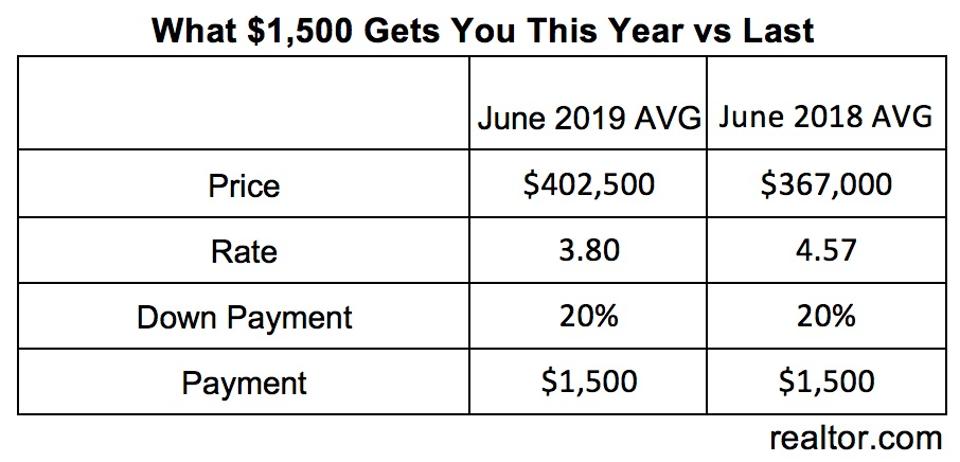

The Federal Reserve on Wednesday cut interest rates for the first time since the Great Recession took hold in 2008, though the move is not likely to deliver significant juice to an already favorable borrowing environment for home buyers. The federal funds rate, which is what banks charge one another for short-term borrowing, will now hover between 2% and 2.25%, according to news reports. The Fed says its decision to lower interest rates is designed to stave off the threat of an economic downturn. But it's unlikely to translate into additional mortgage savings for many buyers. With the interest rate for a 30-year loan already hovering below 4%, the Fed’s move may be more meaningful for buyers with other types of financing, says Lawrence Yun, chief economist for the National Association of REALTORS®. “Many borrowers will benefit, especially those with adjustable-rate mortgages and commercial real estate loans,” Yun says. “The longer-term 30-year fixed-rate mortgages will see little change in the near future because they had already declined in anticipation of this latest move by the Fed. “These low interest rates will partly help with housing affordability over the short-term. Both rents and home prices have been consistently outpacing income growth. The only way to mitigate housing-cost challenges as a long-term solution is to bring more supply of both multifamily and single-family homes to the market," adds Yun. Still, lower borrowing costs are helping buyers manage rising home prices. For example, buyers who spend $1,500 on monthly mortgage payments can afford to purchase a $402,500 home this year compared to $367,500 last year, when mortgage rates averaged 4.57%, according to realtor.com®. “Last year, buyers would have needed an additional $145 a month on top of the $1,500 to afford a $402,500 home,” says Danielle Hale, realtor.com®’s chief economist. In some locales, buyers’ money can stretch even further. “An extra $35,000 in purchasing power, depending on where you are in the country, can really make a difference to buyers today,” Hale says. “It still counts, even with home prices up 6% nationally. That increase in purchase power is greater than the national price increase.” Here’s what some have to say: Danielle Hale, Chief Economist at realtor.com “Lower mortgage rates, higher wages and more homes for sale have helped counteract rising home prices, and ultimately, made it so that buyers are able to afford more than last year.” “Our outlook implies 4% growth for the remaining months of the year, predicated on…more supply than last year, the decline in mortgage rates, moderating home price appreciation and improving affordability.”' Lawrence Yun, Chief Economist at NAR “Rates of 4% and, in some cases even lower, create extremely attractive conditions for consumers. Buyers, for good reason, are anxious to purchase and lock in at these rates.” Doug Duncan, Chief Economist for Fannie Mae “Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market.” Kaycee Miller in a Realtor Magazine article “At the moment, some observers suggest the housing market is indeed headed for a slowdown. But no need to panic — experts say the financial and economic factors that were in play during the big crash a decade ago don’t exist today.” Bottom LineThe housing market will be stronger for the rest of 2019. If you’d like to know more about your specific market, contact me to find what’s happening in your area. Source:

“Realtor.com® Reports How Much More Home Buying Power There Is Today Thanks to Lower Mortgage Rates,” Forbes.com (July 30, 2019); "National Association of Realtors® "What the Fed's Rate Cut Means For Your Buyers" NAR.realtor (July 31, 2019); Keeping Current Matters "What Experts Are Saying About the Current Housing Market" (July 23, 2019). |

AuthorAndrew Starkman Archives

May 2024

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed