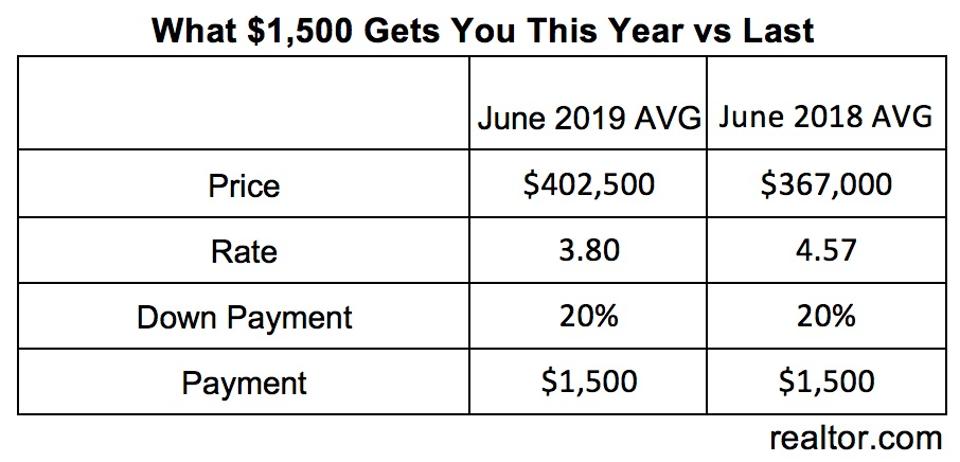

The Federal Reserve on Wednesday cut interest rates for the first time since the Great Recession took hold in 2008, though the move is not likely to deliver significant juice to an already favorable borrowing environment for home buyers. The federal funds rate, which is what banks charge one another for short-term borrowing, will now hover between 2% and 2.25%, according to news reports. The Fed says its decision to lower interest rates is designed to stave off the threat of an economic downturn. But it's unlikely to translate into additional mortgage savings for many buyers. With the interest rate for a 30-year loan already hovering below 4%, the Fed’s move may be more meaningful for buyers with other types of financing, says Lawrence Yun, chief economist for the National Association of REALTORS®. “Many borrowers will benefit, especially those with adjustable-rate mortgages and commercial real estate loans,” Yun says. “The longer-term 30-year fixed-rate mortgages will see little change in the near future because they had already declined in anticipation of this latest move by the Fed. “These low interest rates will partly help with housing affordability over the short-term. Both rents and home prices have been consistently outpacing income growth. The only way to mitigate housing-cost challenges as a long-term solution is to bring more supply of both multifamily and single-family homes to the market," adds Yun. Still, lower borrowing costs are helping buyers manage rising home prices. For example, buyers who spend $1,500 on monthly mortgage payments can afford to purchase a $402,500 home this year compared to $367,500 last year, when mortgage rates averaged 4.57%, according to realtor.com®. “Last year, buyers would have needed an additional $145 a month on top of the $1,500 to afford a $402,500 home,” says Danielle Hale, realtor.com®’s chief economist. In some locales, buyers’ money can stretch even further. “An extra $35,000 in purchasing power, depending on where you are in the country, can really make a difference to buyers today,” Hale says. “It still counts, even with home prices up 6% nationally. That increase in purchase power is greater than the national price increase.” Here’s what some have to say: Danielle Hale, Chief Economist at realtor.com “Lower mortgage rates, higher wages and more homes for sale have helped counteract rising home prices, and ultimately, made it so that buyers are able to afford more than last year.” “Our outlook implies 4% growth for the remaining months of the year, predicated on…more supply than last year, the decline in mortgage rates, moderating home price appreciation and improving affordability.”' Lawrence Yun, Chief Economist at NAR “Rates of 4% and, in some cases even lower, create extremely attractive conditions for consumers. Buyers, for good reason, are anxious to purchase and lock in at these rates.” Doug Duncan, Chief Economist for Fannie Mae “Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market.” Kaycee Miller in a Realtor Magazine article “At the moment, some observers suggest the housing market is indeed headed for a slowdown. But no need to panic — experts say the financial and economic factors that were in play during the big crash a decade ago don’t exist today.” Bottom LineThe housing market will be stronger for the rest of 2019. If you’d like to know more about your specific market, contact me to find what’s happening in your area. Source:

“Realtor.com® Reports How Much More Home Buying Power There Is Today Thanks to Lower Mortgage Rates,” Forbes.com (July 30, 2019); "National Association of Realtors® "What the Fed's Rate Cut Means For Your Buyers" NAR.realtor (July 31, 2019); Keeping Current Matters "What Experts Are Saying About the Current Housing Market" (July 23, 2019).

0 Comments

Leave a Reply. |

AuthorAndrew Starkman Archives

May 2024

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed