|

As a real estate agent in Phoenix, Arizona, I am often asked whether the costs associated with buying a home are tax deductible. The answer to this question is not as straightforward as you might think.

First and foremost, it's essential to understand that the tax laws surrounding home buying costs are subject to change, and you should always consult with a tax professional to ensure you're making informed decisions. However, as of 2021, here are some of the home buying costs that may be tax deductible:

In conclusion, while not all home buying costs are tax deductible, there are some deductions that homeowners may be able to take advantage of. As with any tax-related question, it's always best to consult with a qualified tax professional to ensure you're making informed decisions and maximizing your tax benefits.

0 Comments

In an economy hit hard by the COVID-19 pandemic, impacts to the housing market aren’t cut-and-dried. Demand for homes appeared to drop along with sales in March, but home prices have risen. So, should you buy or sell a house during the pandemic? What does this mean for the average homebuyer or seller? Gary Pivo, a professor of real estate development and urban planning in the College of Architecture, Planning and Landscape Architecture, is a widely cited expert on responsible property investing and sustainable urbanization. Pivo talked to UANews about how COVID-19 might impact the number of homes for sale and sale prices, and whether the pandemic will encourage people to move to less dense areas. He also offered advice for those interested in buying or selling now. Q: How has the pandemic affected the time houses spend on the market? A: There is anecdotal evidence that things are selling more slowly. There’s been a decrease in existing home sales. Historically, there’s a strong negative correlation between time on market and home sales. So, the drop in sales would normally increase time on the market. Also, median months on the sales market for newly completed homes increases during recessions. But some of the drop in sales is from a shrinking market – a decline in both the number of buyers and sellers. So, if there remains some balance between the two, time on the market may not be greatly affected. Q: People like to look at the 2008 financial crisis when they think about the effects of the pandemic on real estate. Is it a fair comparison? A: That was a crisis in our financial system that made it harder to get mortgages. So far, lending policies have remained unchanged, so that’s a key difference. Damage to household wealth did occur then and is happening now and that will weaken demand for housing, but low interest rates will offset that to some degree. But people with uncertain job prospects don’t want to buy houses. Still, on net, I do not expect a downturn in housing prices anything like the 24% drop we saw during the financial crisis. Commercial real estate may see bigger effects, particularly Class B and C retail and office space, if small businesses close, which seems quite possible. Q: How likely is it that lenders change their loan criteria for mortgages in the face of the economic effects of COVID-19? A: As of April 2020, the Senior Loan Officer Opinion Survey on Bank Lending Practices by the Federal Reserve shows lending policies for mortgages have remained basically unchanged, according to 91.1% of the respondents. Q: The housing market in Tucson was steadily growing before the pandemic. How has COVID-19 changed that? A: Financial stress on households should weaken demand, eventually pushing downward the 7% annual growth in housing prices we’ve seen the past two years. I expect to see total returns on investment in the private student housing market in Tucson and elsewhere to crater during the second quarter and that could extend through the year depending on how many students return to the UA in the fall. Q: How might the pandemic foster a counter-urbanization movement? A: This means increasing the share of people interested in living or companies locating outside denser areas, in the suburbs or exurbs or rural towns. In that case, we’d end up developing more open space, paying more for infrastructure and using more energy – all things known to be the result of suburbanization. My guess is this may have some slowing effect on New York City – for example, an Amazon might think twice before investing in a major office center there – but unless COVID-19 gets out of control in several other large urban centers, there won’t be a permanent shift in attitudes toward urban living. Q: What advice would you give people who are thinking about buying or selling a house right now? A: The interest rates are the lowest in history, so if you’re looking to buy a place to call home and have secure income, I’d go for it. If you’re looking for a student housing or a vacation rental investment, I’d wait and see what the future holds. You may get a better price and returns down the road. For sellers, prices are holding up just now and have been rising for the past few years. So, it is a good time to sell even if you may have to wait a little longer to find a buyer. I don’t see much upside to waiting Source: AZ BIG MEDIA Are you buying or selling a home during these uncertain times? Use these tips to remain safe during the spread of COVID-19 aka Coronavirus.

Heeding the call of some of the largest mortgage lenders in the industry, the Consumer Financial Protection Bureau (CFPB) is moving to back the elimination of debt-to-income (DTI) requirements in mortgage underwriting. In a letter CFPB Director Kathy Kraninger sent to Congress today, the CFPB asked to amend the Ability to Repay/Qualified Mortgage rule (ATR/QM rule) in order to remove DTI as a qualifying factor in mortgage underwriting. This rule was created in response to the financial crisis of a decade ago as a way to prevent lending money to borrowers who might not be able to afford the loan. The ATR/QM rules includes eight separate borrower qualifications that lenders must examine when approving a loan. The rule includes things like verification of income, credit history and DTI, among others. The only portion the CFPB is asking to amend is the DTI requirement as a powerful coalition of lenders deems the rule unfair and constraining. In September, a group of lenders and industry groups, including Wells Fargo, Bank of America, Quicken Loans, Caliber Home Loans, the Mortgage Bankers Association, the American Bankers Association, the National Fair Housing Alliance, and others, sent a letter to the CFPB, asking the bureau to remove the 43 percent DTI requirement on both prime and near-prime loans. One reason for the request is that GSEs Fannie Mae and Freddie Mac are not subject to this rule, under a condition called the “QM Patch.” This patch allows loans sold to Fannie and Freddie to exceed the 43 percent DTI requirement, which some lenders say is unfair for those loans backed by private capital. The 43 percent DTI rule also doesn’t apply to government-insured loans such as FHA, VA or USDA mortgages. The Risks of Eliminating DTI Requirements During the height of the financial crisis, in 2008 and 2009, some 3 million foreclosures were filed each year. As a way to prevent another catastrophe, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted, which created the CFPB. Although the economy has recovered, some argue that easing important lending safeguards could pave the way for problems in the future. “Eliminating debt-to-income ratios from underwriting guidelines will result in more loans to consumers with already heavy debt loads and is reminiscent of Congress requiring Fannie and Freddie to buy more subprime loans. That didn’t end well,” says Greg McBride, CFA, Bankrate chief financial analyst. McBride says that the DTI requirement has long been a standard in borrowing, so removing it outright could mean a free-for-all in the mortgage lending space. “The 43 percent DTI standard came about after the goal posts were moved from the previous, long-held standard of 36 percent,” McBride says. “Now they want to just take the goal posts off the field altogether.” Although DTI is an important measure in determining a borrower’s ability to repay a loan, McBride points out, it’s important to understand what’s behind the number. For instance, two people might have the same DTI but a very different financial profile. “Take two different borrowers, each with a 43 percent DTI,” McBride says. “One has a monthly income of $10,000 and the other just $4,000. The higher income borrower has $5,700 remaining after monthly debt obligations whereas the lower income borrower has just $2,280 left over. Through that lens, the lower income borrower might look riskier than a higher-income borrower with more financial wiggle room.” Source: BankRate.com When you're house hunting, the allure of new construction is undeniable. You get to be the first to live in the pristine home—one untouched by grimy hands or muddy shoes. It's full of brand-new appliances and the finishes and treatments that you picked to fit your aesthetic. And you won't have to worry about making any cosmetic or structural upgrades for years.

If you are interested in buying a new construction, the builder's agent will be ready to help you with the process. But make no mistake: You need your own real estate agent from the get-go. Even if it seems like plug and play to sign up with the builder's on-site agent, you're going to want someone representing your side of the deal. What is a builder's agent?When you buy a new construction, the home's builder is considered the seller, and the agent representing the builder is called the builder's agent. "The builder’s agent will always have the builder's best interest in mind,” After all, the job of the builder's agent is to get the highest price for the homes the builder is selling so the agent is not going to be as eager to negotiate down. Why you should hire your own real estate agent It's a good idea to have your real estate agent accompany you on your first visit to the new construction. Why? Because the builder (aka the seller) will be responsible for paying the commission, and needs to know if you'll have a real estate agent representing you. So bringing your agent to the first visit will make it clear that the builder's agent will be on the hook for paying commission. Some builders might even refuse to pay your agent a commission if you don’t register the agent the first time you visit the home on a new construction site. “Your real estate agent's job is to help you get the most value for your money, with the least hassle and frustration,” says Patrick Welsh, a real estate agent with Keller Williams, in Houston. When buying new construction, here’s what your real estate agent will help you with that you might miss out on if you stick with the builder’s agent:

How the builder's agent can help youAll that said, the builder's agent can be a valuable resource for learning about your potential new home. “They are knowledgeable about the construction and available amenities, as well as the housing development and general community vibe,” says Walgrave. You can rely on the builder's agent for background information—just don’t make this individual your sole point of contact on the buying and selling process. Everyone wants to walk away from buying a home—whether it be a new construction or not—with peace of mind. Having a real estate agent in your corner will help facilitate that. The other day a friend of mine reached out and said, “Andrew, I think I’m ready to start exploring buying my first home. What do I do first?” If you’re in the same boat or want to learn more about the process of buying a home, watch my latest video: ‘The Home Buying Process in 10 Minutes’.The growing need for affordable housing near Downtown Phoenix is being addressed by three apartment projects that combine affordability with amenities.

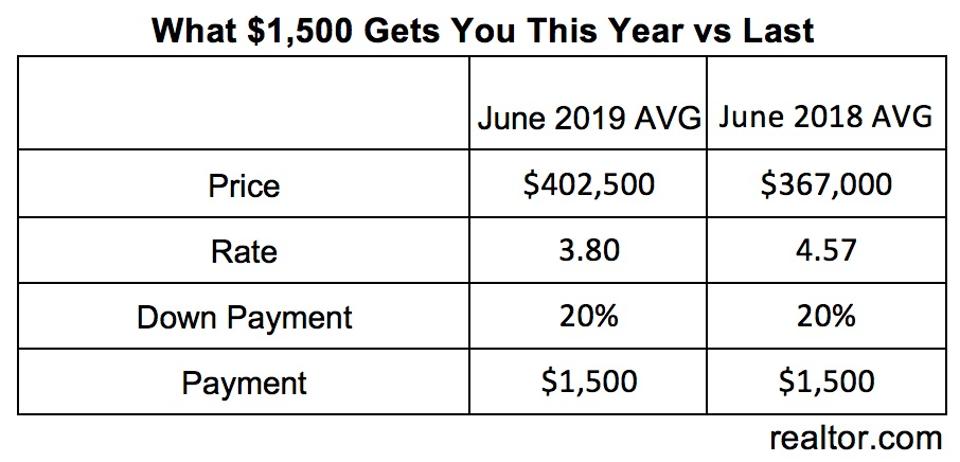

Pacific Oak Capital Advisors, a national leader in institutional-quality alternative investments, and Defer Gain, a leading Arizona-based real estate development company specializing in Opportunity Zone investments, have announced the signing of a joint venture arrangement to develop, finance, and operate multi-family, commercial, and industrial income producing properties in Arizona Opportunity Zones. The Pacific Oak – Defer Gain joint venture is kicking off its union with three multi-family projects in the Downtown Phoenix’s Presidential District, including the 241-unit St. Ambrose Apartments and the 84-unit Presidential Apartments both situated between 11th and 12th Streets and Van Buren and Jefferson Streets in Phoenix. Both projects are also strategically located next to the 12th Street light rail stops. The joint venture will also start construction in September 2019 on the work-force housing project known as the Imperial Apartments located near 20th Street & Roosevelt in Phoenix. The Imperial Apartments breaks ground next month, and will be Arizona’s premier, and much needed, work-force housing project located in the heart of the Edison Eastlake Choice Neighborhoods, which has begun a $150 million redevelopment project. The 140 unit private project will join the addition of 1,100 new City of Phoenix housing units, propelled by a $30 million federal grant recently awarded to the Choice Neighborhood. “The Imperial Apartments is located directly across from the soon to be expanded Edison Park, which is a significant amenity in the neighborhood,” said Michael Lafferty, Partner at Defer Gain. “We are excited to bring affordable, high quality, housing solutions to this fantastic neighborhood and be a part of its transformation with the City of Phoenix and Edison Eastlake stakeholders.” Phoenix Mayor Kate Gallego commented, “Adding quality housing is a top priority for our city. I am excited to see new housing, including much-needed workforce units, near our key job corridors in the downtown and airport area.” Defer Gain’s two Presidential District projects, St. Ambrose and Presidential Apartments, will continue co-founders Mr. Lafferty and Scott Tonn’s efforts to provide housing solutions in the area east of 7th Street near the City of Phoenix’s 12th Street Light Rail Station. “Defer Gain is one of the first developers to offer high-amenity efficiency apartment living in Downtown Phoenix,” said Tonn, a Defer Gain Partner and Co-Founder. “As well, we are very excited to implement the benefits of the newly minted Opportunity Zone legislation in conjunction with the local community to make St. Ambrose and Presidential Apartments significant additions for the neighborhood. This collaboration will also provide new residents with access to a dynamic job market in Downtown Phoenix.” “It’s exciting to see Opportunity Zone developments providing support to a critical component of our state’s economy — the workforce,” said Sandra Watson, President and CEO of the Arizona Commerce Authority. “We thank Pacific Oak and Defer Gain for advancing these three projects in downtown Phoenix neighborhoods.” Positioned at the 12th street light rail stops, both the Presidential and St. Ambrose Apartments are just one stop from Downtown Phoenix and three stops to Sky Harbor Airport. Both properties boast state-of-the-art amenities including luxurious lobbies, mail rooms including secured lockers for packages, grocery delivery cold/ freezer storage, clubhouses, multi-purpose rooms, private conference rooms, exercise facilities, resort style swimming pools, cabanas with private BBQ’s, secured ingress/egress, great walkability & easy access to public transportation. In addition, the Presidential Apartments offers large format on-site personal locker storage. While both properties feature street level retail/mixed-use opportunities, the Presidential Apartments will additionally include three open-air areas on Jefferson Street, adjacent to the light rail stop, which will attract local artists, pop-up businesses, food trucks, and events open to the public. “The collaboration between Pacific Oak Capital Group and Defer Gain will provide us a unique opportunity to penetrate the Arizona Opportunity Zone market,” commented Keith Hall, Co-founder of Pacific Oak. “We are delighted to be in partnership with Defer Gain’s team and look forward to being a dominant force in the Arizona OZ space for years to come.” Source: AZ BIG MEDIA  The Federal Reserve on Wednesday cut interest rates for the first time since the Great Recession took hold in 2008, though the move is not likely to deliver significant juice to an already favorable borrowing environment for home buyers. The federal funds rate, which is what banks charge one another for short-term borrowing, will now hover between 2% and 2.25%, according to news reports. The Fed says its decision to lower interest rates is designed to stave off the threat of an economic downturn. But it's unlikely to translate into additional mortgage savings for many buyers. With the interest rate for a 30-year loan already hovering below 4%, the Fed’s move may be more meaningful for buyers with other types of financing, says Lawrence Yun, chief economist for the National Association of REALTORS®. “Many borrowers will benefit, especially those with adjustable-rate mortgages and commercial real estate loans,” Yun says. “The longer-term 30-year fixed-rate mortgages will see little change in the near future because they had already declined in anticipation of this latest move by the Fed. “These low interest rates will partly help with housing affordability over the short-term. Both rents and home prices have been consistently outpacing income growth. The only way to mitigate housing-cost challenges as a long-term solution is to bring more supply of both multifamily and single-family homes to the market," adds Yun. Still, lower borrowing costs are helping buyers manage rising home prices. For example, buyers who spend $1,500 on monthly mortgage payments can afford to purchase a $402,500 home this year compared to $367,500 last year, when mortgage rates averaged 4.57%, according to realtor.com®. “Last year, buyers would have needed an additional $145 a month on top of the $1,500 to afford a $402,500 home,” says Danielle Hale, realtor.com®’s chief economist. In some locales, buyers’ money can stretch even further. “An extra $35,000 in purchasing power, depending on where you are in the country, can really make a difference to buyers today,” Hale says. “It still counts, even with home prices up 6% nationally. That increase in purchase power is greater than the national price increase.” Here’s what some have to say: Danielle Hale, Chief Economist at realtor.com “Lower mortgage rates, higher wages and more homes for sale have helped counteract rising home prices, and ultimately, made it so that buyers are able to afford more than last year.” “Our outlook implies 4% growth for the remaining months of the year, predicated on…more supply than last year, the decline in mortgage rates, moderating home price appreciation and improving affordability.”' Lawrence Yun, Chief Economist at NAR “Rates of 4% and, in some cases even lower, create extremely attractive conditions for consumers. Buyers, for good reason, are anxious to purchase and lock in at these rates.” Doug Duncan, Chief Economist for Fannie Mae “Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market.” Kaycee Miller in a Realtor Magazine article “At the moment, some observers suggest the housing market is indeed headed for a slowdown. But no need to panic — experts say the financial and economic factors that were in play during the big crash a decade ago don’t exist today.” Bottom LineThe housing market will be stronger for the rest of 2019. If you’d like to know more about your specific market, contact me to find what’s happening in your area. Source:

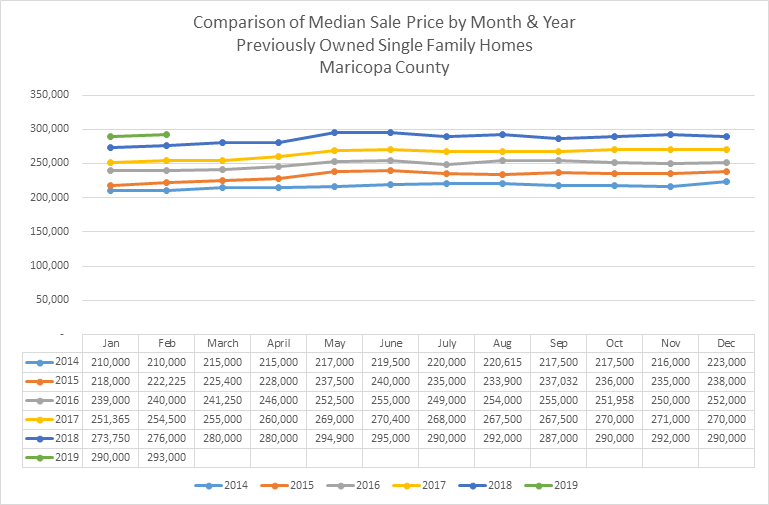

“Realtor.com® Reports How Much More Home Buying Power There Is Today Thanks to Lower Mortgage Rates,” Forbes.com (July 30, 2019); "National Association of Realtors® "What the Fed's Rate Cut Means For Your Buyers" NAR.realtor (July 31, 2019); Keeping Current Matters "What Experts Are Saying About the Current Housing Market" (July 23, 2019). Source: The Wilcox Report | AZ Business Magazine For the first time, the single-family resale price of a home in Maricopa County was more than $300,000, ending at $308,000 in May, according to Fletcher R. Wilcox, vice president Grand Canyon Title and author of The Wilcox Report. Wilcox said the reason for the record sale price is demand fueled by population and job growth. Maricopa County was the No. 1 county for its population increase in 2018, according to the U.S. Census Bureau. Companies are moving to Maricopa County to seek employees because of its population growth. People are moving to Maricopa County because they see companies moving here. It is a momentum playing off each other, and I see this continuing. Both people and jobs will continue to fuel the demand to own a home. There were 7,562 sales of single-family resales in May. This is the highest number of sales since June 2011 when there were 7,790. According to Wilcox’s report:

• The median sale price for a single family resale ended at $308,000 in May 2019. This is now the new monthly record high for the median sale price. The month with the previous highest median sale price was March 2019 when it was $297,000. Before this time, the record month was June 2018 at $295,000 and before that time we have to go all the way back to the pre-real estate recession month of June 2006 when it was $287,500. • For the second month in a row, the year-over-year slow-down for sales of single-family resales has ended. Sales of single-family resales in Maricopa County (Greater Phoenix) in May 2019 were 7,562. This was 430 more or 5.1% higher than May 2018. Sales were also higher in April 2019 over April 2018. Previous to April 2019, sales were down year-over-year for eight consecutive months starting in August 2018. See Table one. Another highlight for May 2019 is that 7,562 sales is the highest number of sales for a month since June 2011 when there were 7,790 sales. But in June 2011 the median purchase price for a single family resale was $126,500 compared to $308,000 in May 2019. • New monthly listings of single family resales were up year-over-year in both May and April. They were down year-over-year in February and March. • When comparing sales of single-family resales in May 2019 to May 2018 we see a substantial decrease in sales under $200,000. In this price range, there were 350 fewer sales in May 2019. A reason for this decrease is that since purchase prices keep going up there are just fewer homes for sale in this price range compared to last year at the same time. In almost every sale price range at $250,000 or above, we see a year-over-year increase in the number of sales. There were 721 more sales at $250,000 or above this May over last May. Sales in the $200,000 to $249,999 price range were almost breakeven, there were seven fewer sales this May compared to last May. Summer is a season best spent outdoors—and preferably by the water. But conventional pools are laden with chlorine, which smells nasty and can irritate eyes and damage hair. Fortunately, there's a growing trend towards natural swimming pools, which are treated with aquatic plants and other biological filters instead of chemicals. These chlorine-free pools offer a serene back-to-nature experience that's hard to beat. Check out the pros & cons of natural pools at the end of the post. Having completed nearly 70 biologically filtered pools across Australia, Natural Swimming Pools Australia was recently commissioned to convert an existing chlorine pool into a natural pool for a large homestead at the iconic Detroit Station in New South Wales. The team converted the pool just in time for the visit of Prince Charles and Camilla Parker Bowles. The natural pool trend began in Europe several decades ago. Since then, they’ve been slowly gaining popularity in the United States, Australia, and other regions with sunny climates. Unlike a traditionally rectangular, chlorine-filled swimming pool, a natural pool is often designed to imitate pools, ponds, or other bodies of water in the wild—they can have irregular shapes, along with rocks, waterfalls, and boulders. Naturally, not every pool built to look like a natural body of water with realistic rocks and boulders is a natural pool.

Unlike most sparkling blue swimming pools, natural swimming pools or ponds (NSPs) are filtered organically rather than by chemicals. Another pool called a regeneration zone is built nearby, which is where the water enters either a gravel filter or a constructed wetlands made of plants that clean the water. This resembles the process by which aquatic plants clean ponds in nature and results in a pool no less clean than one with chemically filtered water. The natural pool and its regeneration zone actually build a small ecosystem that changes over time, and animals or insects often are attracted to the zone (but not the pool, thankfully—it doesn’t contain the environment they’re looking for). These organic ponds are gaining popularity across the U.S., but there are some pros and cons that you should carefully consider before deciding to install a natural rather than a conventional pool: Pros

|

AuthorAndrew Starkman Archives

May 2024

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed